Covid-19: A Chance To Define Your Investment Behaviour

March 30, 2020

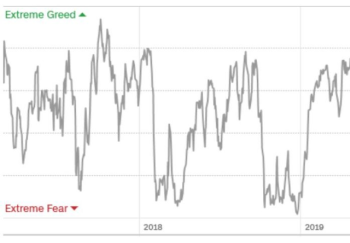

Greed & Fear shapes investment experience, which in turn defines future (gambling) behaviour

In my previous blog, I talked about one’s investing experience driven by greed and fear – seared into memories that shape our future behaviour. I shared that the swings between excessive greed and excessive fear lead to behaviour that is like gambling.

Let me start with my personal investment (gambling) behaviour.

I have seen many crises in my government and financial career. Some severe. Some very severe. I recall the 1987 market crash, 1991 recession, 1997-98 Asian Financial Crisis, 2000 Dotcom bust, 2007-2008 Global Financial Crisis, 2015 China market crash, and many more geopolitical and military conflicts in between. I remember struggling to deal with my emotions of watching grown men cry at a hawker centre in Bukit Merah after the 1987 Black Monday market crash.

I had just started working. Coming from a low-income family, I never had more than $20 in my post office savings account. When I was growing up, almost any “hongbao” money collected by us siblings during Chinese New Year was handed back to our parents for recycling. What little family money was often spent on lottery tickets and horse races. Hence, my anti-gambling attitude.

I had a little more cash when I enlisted into the military and remember being so happy to see “$90” printed - letter by letter - credited to my little blue book. So whatever money I had, I saved. Despite my economics and accounting degree, I only focused on public policy and did not look at investing – only in my meagre bank savings account.

Our saving, spending and sharing behaviours are largely shaped by our personal experiences.

So, combined with my childhood money experience, the “Bukit Merah experience” was a shock to my confidence in investing (gambling). It confirmed the dangers of investing, where seemingly career established and grown men can break down and cry. You can lose it all or almost. And for those who are old enough (I am), I had to ingest the almost daily news saturation of the so-called “Pan-Electric Crisis” [1] in 1985 and its aftermath – before returning to Singapore to complete my remaining National Service term.

Now Looking Back Rationally…

For many, memories of these crises and many smaller crises -which at some point threatened global or regional stability - have largely faded. For example, during the 2008 Global Financial Crisis, how many remember the stress of wondering if your ATM card would work the next day and the contagion spreading from one failing bank to a suspicion of a bank that everyone takes for granted as being as “solid as a rock”. As the founder of a fast-growing wealth management business, I did. The lesson I take away is that such fears beyond the original cause can - in themselves – cause self-fulfilling prophesies.

Looking back, we have mostly recovered from these crises. But every crisis has definitive casualties who will never forget. These are the defining moments. Extremely painful. It’s like how you feel after a painful, lung-crushing and heart collapsing run. You can’t feel your legs. Only your brain feeling the pure weight of lead – whenever you lift one foot to take a tiny small step. Yes, we have all been there.

But like all painful mental daggers, a sense of light-headed comfort and relaxation accompanied by an innate sense of accomplishment will come soon – when recovering from that pain. That’s the defining moment to be seared into memory while the filling melts into obscurity – for future retrieval.

Like every crisis, every life has its defining moments. But we choose what we recall and what we repress. For a generation, it will be a shared defining moment with individual variation in tint and intensity. But still, a defining moment nonetheless for future recall.

…and here is how I hope your investment (not gambling) experience will be shaped for the better.

First, let’s see where Covid-19 stands [2].

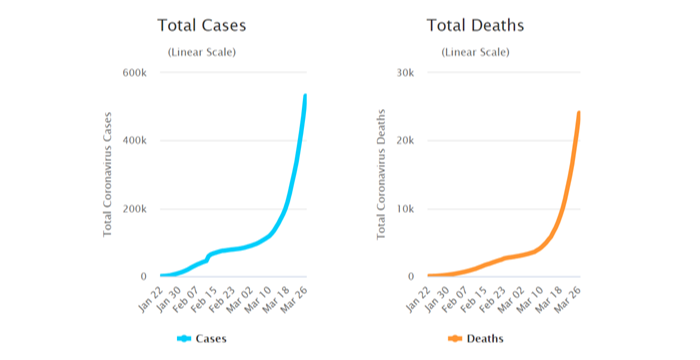

As of 27 March 2020:

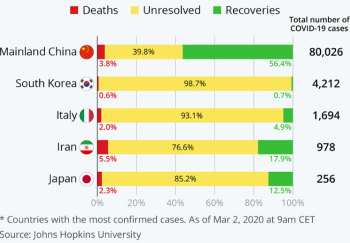

- Almost 600,000 confirmed cases and over 27,000 deaths across 199 countries [3]. What’s important to note about the numbers is the pattern.

- USA (102K confirmed) now exceeds China (82K) in terms of confirmed cases.

- China is recovering with life slowly returning to normal.

Second, let’s assess the likely scenarios of how the world will respond.

Cautiously Optimistic Case: Covid-19 is seasonal and will continue spreading widely in the Western Hemisphere until end-April. With over 2 billion in lockdown, Asia peaks earlier. Safe distancing slows the spread and healthcare capacity catches up. But the very same measures that Covid-19 causes rising unemployment as consumer demand collapses. Financial stress and bankruptcy soar. We see a global recession until September 2020 before a slow recovery.

Pessimistic Case: Covid-19 is not seasonal and continues spreading in the Western Hemisphere until end-May because of poor management and leadership in the public-health response. Countries that managed to tame the spread continue public-health measures to prevent resurgence – leading to a deeper global economic impact as supply chains are disrupted. Fiscal and monetary policies fail to dampen the negative economic impact. Global recovery begins in the second half of 2021.

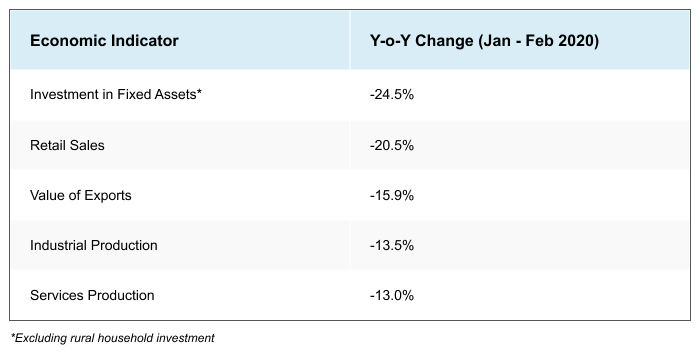

Currently, China seems to have contained Covid-19, but the economic impact is still severe [4].

This is historic. China’s GDP will fall in 1Q2020 - the first time since 1976.

Currently, about half the USA population is on stay-at-home (SHN) orders. The week ending March 21, USA unemployment claims reached a record 3.3 million. In contrast, the Global Financial Crisis recorded a high of 665,000.

The IMF is forecasting a global recession in 2020. On the bright side, some analysts are forecasting a recovery as early as the third quarter of 2020.

What do these all mean for a true investor?

Currently, analyst opinions are a dime a dozen. So is mine. Beware.

The difference is that my opinion doesn’t really matter anymore. Why?

Having lived long enough and dipping into my childhood traumas, I have finally decided to confront my investment (gambling) demons. I have lost more money than I have risked over the years – whenever I invested in individual stocks. How many stocks can I really track? And now - even more, as markets become global - and I do need my sleep. And even as I track individual stocks, what advantage do I get – when information and speculative rumours abound in real-time within cyberspace?

When I was an investment analyst when the internet was not yet ubiquitous, I would walk the ground visiting plantations and factories to count the number of loaded container trucks versus what management claimed – rather than follow what other analysts opined from their office chairs. I could get some information advantage because a phone call (even expensive international calls) was faster than me typing on a PC and sending it via a 9600 bps speed fax modem (warning: age test here!). And it mostly worked! But not anymore. Now, companies dish out information in real-time, simultaneously and globally. There is no time advantage. Prices of stocks are now available 24/7, literally right on your toilet seat. So, it is more sheer buying and selling power that will move stock prices.

In short, everyone can have an opinion, and share it instantly with anyone, anytime, anywhere.

The hard truth is that if you are so good, then why are you still an analyst? Or an investment manager? Why do you have to manage someone else’s money? The hard truth is that your method is to make money from someone else’s money – sometimes, even when that someone else loses money!

So, think again why you have money invested in a unit trust or mutual fund. What are the charges? Are the fees aligned with the performance of the so-called investment? Read my blog about unit trusts if you wish to get more insights.

It means that as a true investor, picking stocks is like picking a horse. Picking the horse race is like picking the industry sector. Picking which country is hosting the horse race is like deciding the geographical stock market you want to bet in. And that’s it. Buying and selling stocks is betting.

Sure, we may say what we need to professionalize, rationalize, regularize - whatever. In effect, we’re justifying why gambling at a horse race is different from investing (trading) in the stock market. Good luck (no pun intended)! There is simply no ample justification. Buying and selling stocks is like gambling. There is no complete information. Professionally, we are taught to diversify our bets. Sure, we try. But honestly, how do we do that diversification? Mostly and truthfully, by my individual gut feel, the seniority of my title, how dependent the bosses are on me or how loud I can be, among other personal dominance strategies.

A true investor must not do any of the above. Worse, a true investor should not be outsourcing such gambling behaviour to someone else who claims to be a better gambler through experience or professional titles – and still charge me one of the highest fees in the world [5]!

A true investor must now use the latest technology to find the best possible return for the risks you are willing to take. For those who are unsure what risks, try our proprietary gamified risk profiler which uses data analytics to predict a suitable investment risk for you – based on your time horizon versus your age, your income stability, your risk-taking style and investment knowledge garnered through a simple 2-minute game.

Replacing Human Emotions with SqSave AI

In 2016, I decided to leverage artificial intelligence (AI) to improve investment outcomes by replacing the alternating currents of human emotions - greed and fear – with real-time 24/7 data analytics.

Don’t get me wrong here. There have been algorithm trading systems for years. These are mostly trade-secrets and you will not know the rules by which the algorithms have been constructed. These are what we call “alpha” trading systems – which maximizes returns. These are “black-boxes”.

SqSave AI is transparent. Read all about it here. Our investment outcome follows Nobel Prize-winning Markowitz Portfolio Optimization which searches for the highest probable return for a given risk level chosen. The key technical challenge all these years was to predict and stabilize the risk. With AI techniques such as machine learning and the real-time financial datasets available cheaply, it is now possible to replace the human gut feel approach with a disciplined time horizon driven AI machine learning system to diversify across stocks, sectors, geographies and asset classes. And that’s what we built SqSave to be.

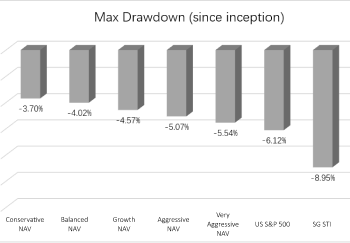

Now before you ask me how SqSave performs, think of the risk management first. Ours is not an “alpha” returns maximizing system (which also means a risk of maximum loss). Ours is not a “beta” passive system which simply follows the market. Ours is a dynamic asset allocation system that combines alpha and beta. We diversify based on data analytics which machine learning has taken over – since SqSave’s basic logic was trained in 2016 and validated since then till today. Between risk and return, SqSave is more towards risk management. And it is important to emphasize that SqSave is not a fund. You get your own personal portfolio. Your portfolio is managed by SqSave according to the time horizon you input and your age. Hence, it is very likely that in the short term, you will not see SqSave making buy and sell decisions simply because markets are gyrating due to Covid-19 fears or because interest rates are set at zero.

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing.

[1] The Pan Electric Crisis, 1985 – History.sg

[2] Covid-19 is an evolving human tragedy, affecting all humankind with a deep impact livelihoods. Hence, some data in this blog will soon be out of date. Go online to get the latest data.

[3] https://www.worldometers.info/coronavirus/ Note that data variability is wide due to the different standards of testing, reporting efficiency and health capabilities, among other causal factors.

[4] China National Bureau of Statistics

[5] Business Times, “Singapore mutual funds charge 'higher fees than global average'”, 19 Sep 2019

More Articles more

SqSave portfolios are doing fine despite Covid-19

Team SqSave

Despite the world fighting the Covid-19 outbreak, SqSave's portfolios are still showing positive

performance. Our investments are well-diversified across global markets.

Read more

Market Update Mar 2020

Team SqSave

Major benchmark indices such as the Dow, S&P 500 and Nasdaq had the worst week since the Global Financial Crisis of October 2008.

a href="../blog/market-update-mar-2020.html" class="text-orange">Read more

Covid-19: Has Fear Run Ahead of Markets?

Team SqSave

Greed and fear are the driving forces behind buying and selling decisions. We buy when there is an excessive greed. We sell when there is an excessive fear.

Read more