How My SqSave Portfolio Behaved

Through the Covid-19 March 2020 Market Crash

May 19, 2020

Application of AI Techniques for Smarter Investing

SqSave is a fully automated risk-based investment management service which uses machine learning AI techniques to construct and manage portfolios to target longer-term risk-adjusted returns.

In a previous blog, I shared why taking out emotion and gut feel from conventional investment management is so important. I also explained in another blog that the application of AI techniques allows us to do so.

Our SqSave AI has been trained over more than 13 years of data. While we have trained and back-tested our SqSave investment system to cover the Global Financial Crisis of 2008, the interesting test is how it navigates an actual live market crash and ongoing volatility.

Why Humans Get Away So Easily Compared to Machines

It’s really funny that humans ask so many questions about how our machine works. In my previous years as an investment manager, hardly anyone asked me why I bought or sold certain investment security. No one asked about my temperament or mood when I made the actual investment decisions. No one asked whether I was even watching the markets or bothered that I was on holiday (and therefore, could not really watch their portfolios). No one asked me how I could monitor so many client portfolios then, and so on.

Certainly, no one asked me how my buy/sell methods worked. Yet, humans are so curious or exacting when it comes to quantitative or data-driven investing. Certainly, human decision making cannot be consistent versus a machine!

A closer look at my SqSave Portfolio

Well, let me entertain the human curiosity. At SqSave, we don’t have a fund or a unit trust with every investor sharing one big portfolio. At SqSave, each investor owns a separate portfolio.

In this blog, I will review my personal portfolio which was started in June 2019 - when we first pilot-tested SqSave. Please note the disclaimers.

How does our SqSave machine behave when there are big shocks to the market?

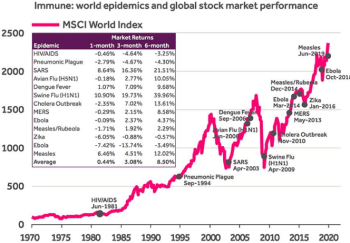

In Mar 2020, we saw a historic market crash arising from the economic coma imposed in several countries to slow the Covid-19 pandemic.

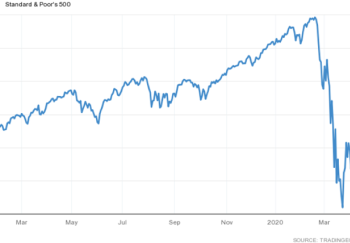

The S&P500 index dropped 34% from a high on 19 Feb 2020 to the low on 23 Mar 2020. Since then, the S&P500 recovered in April, but remains 16% below its previous peak.

Let’s review two things:

- How did my SqSave portfolio behave during the crash?

- How has my SqSave portfolio performed since?

How did our SqSave AI react to the market shock?

Well, SqSave did not react much despite the heightened market volatility.

Our SqSave AI is not designed to do trading. It does not seek quick returns. Active investment methods to squeeze out returns over and above the general market are what’s called “alpha” strategies. Instead, SqSave stays focused on the risk parameters of the portfolio that will match with your personal risk setting. Like most human-managed portfolios, my SqSave portfolio fell with the market. But SqSave focuses on managing the downside risk.

So how did my SqSave portfolio do?

In short, I can’t complain. SqSave did what it is supposed to do. And I was pleasantly pleased to see how calm and focused my SqSave portfolio stayed.

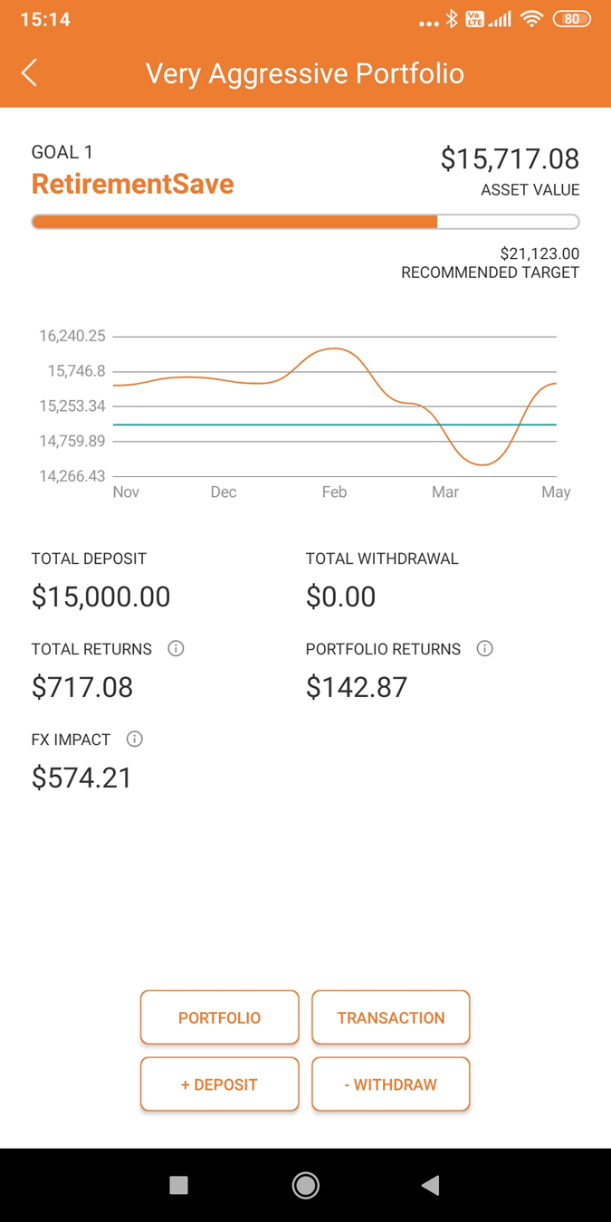

My portfolio was set at the Very Aggressive risk rating.

It was started in June 2019 and rose steadily from my initial capital of SGD 15,000 to more than SGD 16,000 in Jan 2020.

That’s over 7 per cent in just 8 months or about 11 per cent per annum. Not bad!

However, the portfolio peaked with the market in mid-Feb and fell along with the market crash into March.

Even then, my portfolio is now valued at about SGD 15,700 which is above my initial capital of SGD 15,000.

That’s impressive to me! Given how global markets have done, my SqSave portfolio has done very well.

Most global markets are still below their previous peaks! And many “alpha” hedge funds who showed positive returns before the crash – now show very bad returns. Many are struggling to recoup the losses.

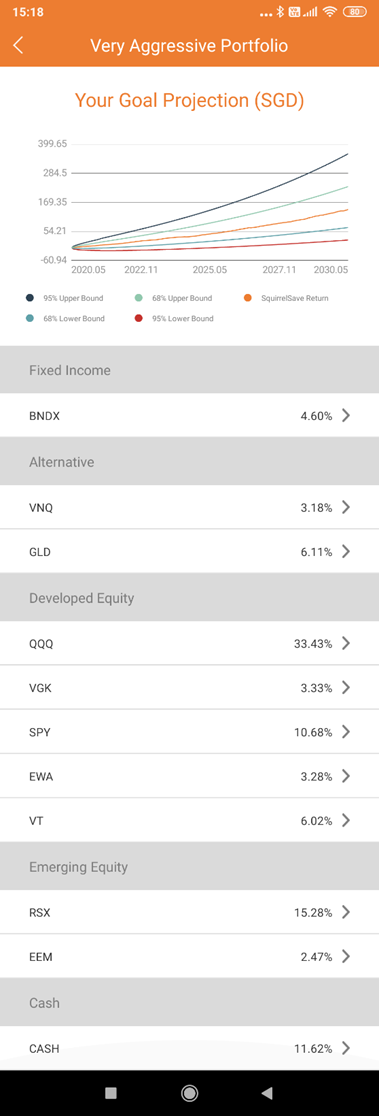

In the next table, I will show you my portfolio composition.

SqSave AI has allocated my investments into 11 asset classes (including cash).

This is not easy for a human investment manager to set up, let alone track and rebalance.

Yet, our SqSave AI is doing all these.

Interestingly, SqSave AI has allocated a good proportion into a Gold ETF (GLD) which has helped my portfolio weather the recent storm.

Individual portfolios will have different relative performances because of many factors, including how long the portfolio was set up and invested before the market crash.

Generally, if your portfolio was set up just before the market crash (when markets were at record highs), your portfolio will be more adversely affected.

However, if you start early and stay invested, like my SqSave portfolio which was set up long before the market crash, your portfolio will probably ride the volatility relatively much better.

Appreciate the discipline of investing early – so as to build up the capacity to weather volatility. It is also instructive to see how emotions are not in the way when markets are very volatile and uncertainty is high. Our SqSave machine was clearly and coldly focused on my personal portfolio, and everyone else within the SqSave ecosystem.

And it is worth sharing that SqSave AI gave the same and will give the same attention to every SqSave investor, even if your portfolio is just a dollar.

Of course, there are other SqSave investors who are still below their initial capital – but it is important to remind ourselves that in investing, these are unrealised losses. As long as we stay the course, there is every probability that the portfolio will recover and grow over the medium to long term.

I hope this sharing gives you some insights into our SqSave investment service.

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing.

Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

Is Covid-19 different from the past crisis?

Team SqSave

Yes, Covid-19 is different from the causes of previous crises. There is deliberate policy-induced economic contraction – unlike other crises.

Read more

Getting It Right: Realised and Unrealised Gains/Losses

Team SqSave

In typical gambling behaviour, people are mostly heading for the exits because they have lost everything (including what they won previously).

Read more

Sharp Recovery Since the Covid-19 Crash

Team SqSave

In typical gambling behaviour, people are mostly heading for the exits because they have lost everything (including what they won previously).

Read more