Shhh!!! My SqSave Portfolio Seems to Know Something About Gold

July 10, 2020

Gold is rocketing!

Memories hopefully are still fresh. As people around the world enjoy various stages of economic reopening, thinking it’s back to pre-Covid normal – I say, “You’d better wake up!”.

One clear indicator is the price of Gold. Like some sports car enthusiasts, the thrill of speed is the adrenalin rush. But for those of us watching with a risk management bias, we’d say, “Hey! Watch your speed – because the data tells us that most often than not, you’re likely to lose control and crash at such crazy speeds”. But with crowds cheering in the same echo chamber, such risk management concerns are not at their forefront.

So what does it mean for us as smart investors?

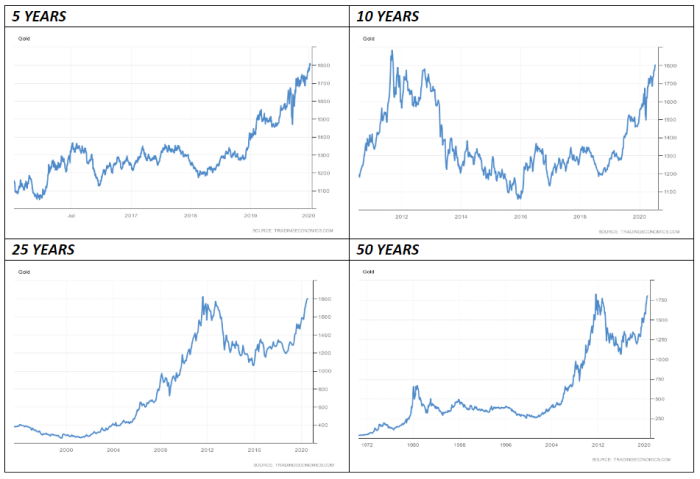

Let’s get a perspective. Below is the spot price of Gold shown in 5-Year, 10-Year, 25-Year and 50-Year charts.

Gold Spot Dollar Price (XAU USD)

If you look at the 5-Year chart, it says Gold is doing well and suddenly in June 2019. It has accelerated in early 2020.

The 10-Year chart shows that this recent acceleration is bringing Gold back to its previous peak seen in Aug 2011. The 2011 bull run in Gold was fuelled by massive cash infusions (e.g. Quantitative Easing “QE”) by the US Federal Reserve to respond to the US 2008 mortgage crisis which became the Global Financial Crisis. In fact, the US Fed was simply printing more US dollar notes for injection into the economy.

The 25-Year and 50-Year charts give you an idea of how much Gold has risen! The rise in the Gold price from 2001 to date massively outguns the Gold price movements in the previous 30 years since the US dropped the Gold Standard to back the US dollar note.

Cash Infusion is Inflating Monetary Assets, but Rising Debt is inflating Gold…

The Covid response has been mainly more cash infusions into local economies across the globe. In Singapore, we are fortunate that responsible government was able to dig into hard-earned reserves to avoid taking on national debt. This is not so elsewhere, and in the USA, in particular.

The USA is the world’s largest debtor. Interestingly. China was the largest holder of USA debt (USD 1.1 trillion) until it was pushed to second place by Japan (USD 1.3 trillion) in June 2019. Japan’s negative interest rates and its close political ties to the USA are the main reasons. The third-largest holder – the UK, is far away at about USD 0.4 trillion.

With rising China-USA tensions, I doubt the Chinese will be as enthusiastic as the Japanese in taking on more printed US dollar notes. People are watching as economic realities which were already unravelling before Covid-19 accelerated the negative trends.

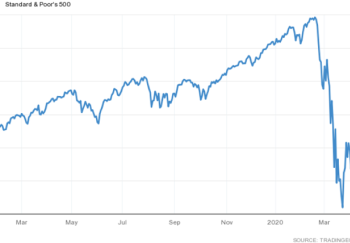

The gap between economic reality and monetary assets is widening – as US stock markets hit new highs alongside rising unemployment and benign inflation. No wonder the rise in Gold as smart investors flock to safer assets.

What does SquirrSqSaveelSave think about all this?

At SqSave, our AI algorithms do not look at short term trading indicators. Instead, we focus on the predicted risk parameters and choose a portfolio to navigate the choppy waters. SqSave is a fully automated risk-based investment management service which uses machine learning AI techniques to construct and manage portfolios to target longer term risk-adjusted returns.

Taking out emotion and gut feel from conventional investment management is important. Application of AI techniques allows us to do so. And that’s why I started SqSave.

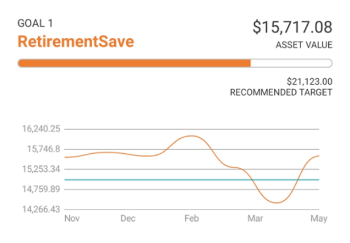

My SqSave Portfolio

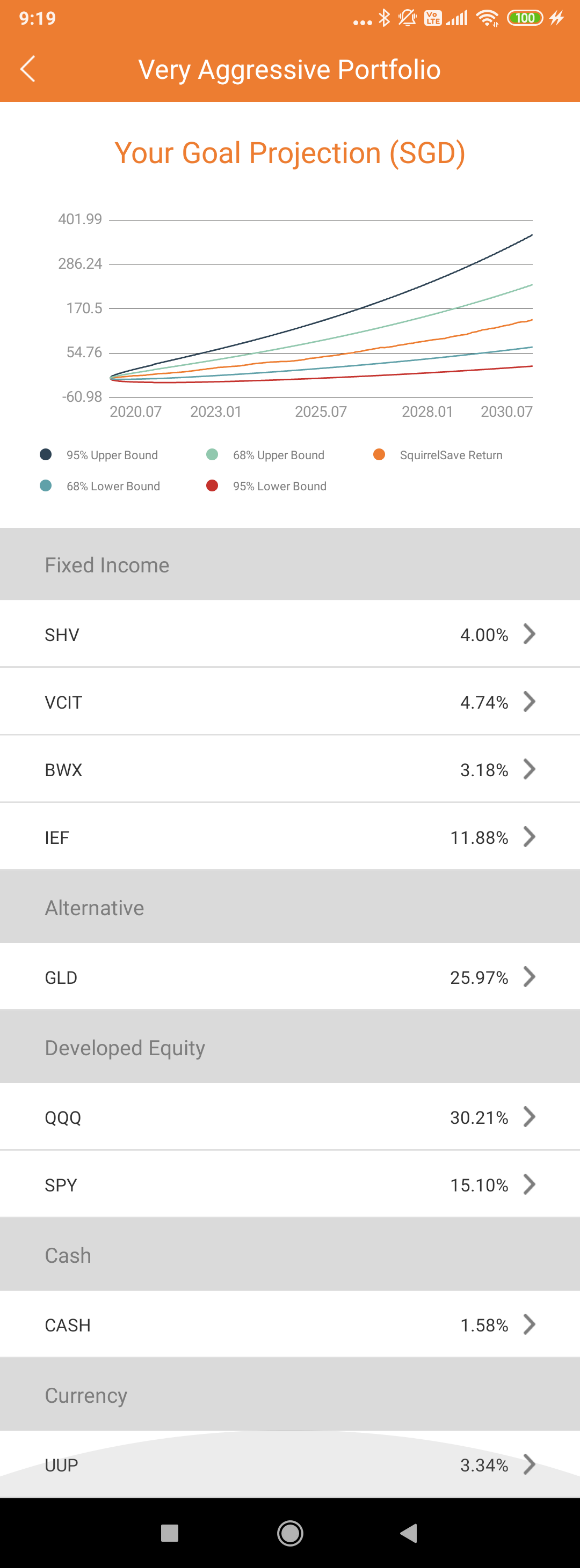

I am happy to see that since mid-2019, SqSave decided to allocate more into Gold. This is not what I would have done as a human investment manager.

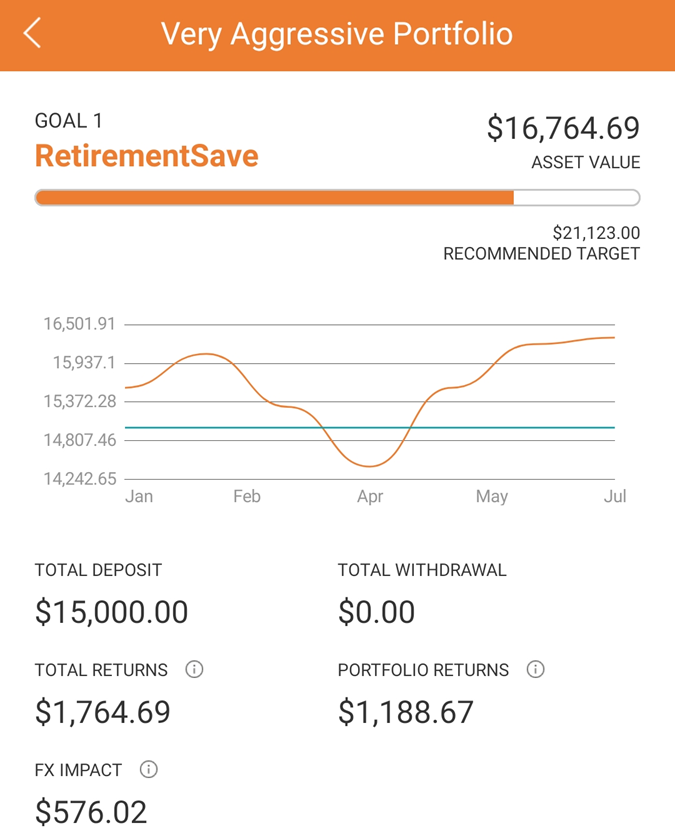

Now, the Gold allocation is helping my portfolio along. As you can read in my previous blog, not only has SqSave handled my portfolio’s downside performance well during the March 2020 Covid crash, it has also recovered well.

SqSave continues to watch over my portfolio 24/7. It seems to understand the risks ahead and has decided on a significant portfolio allocation to Gold – alongside the riskier QQQ (Nasdaq 100) asset class.

Figure 2: My Actual Portfolio

Portfolio - Performance

Portfolio - Asset Allocation

If you read my last blog, my portfolio value was below SGD 16,000. Short term movements are not our focus. But it is instructive to see how smart asset allocation can help drive performance per unit of risk taken.

The New Normal – and Work From Home….

Covid continues unabated across the globe. We don’t know if and when a vaccine will be found. Every nation is seeking a balance between lives, jobs and the future. We need to know that there is no return to a pre-Covid normal.

As people embrace the concept of Work From Home (WFH), there will be structural changes in how we live, love, work and play. In the next blog, my colleague – Eric Chia and I – will share a little more on what we see arising from WFH.

That’s it for now. Do stay safe and healthy as Covid is still swirling around the world. Watch out also for dengue! The world is a risky place. It’s time you put some money into SqSave and invest smarter. Stop trading (gambling) and start Smart Investing!

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing.

Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

Getting It Right: Realised and Unrealised Gains/Losses

Team SqSave

In typical gambling behaviour, people are mostly heading for the exits because they have lost everything (including what they won previously).

Read more

Sharp Recovery Since the Covid-19 Crash

Team SqSave

In typical gambling behaviour, people are mostly heading for the exits because they have lost everything (including what they won previously).

Read more

How My SqSave Portfolio Behaved Through the Covid-19 March 2020 Market Crash

Team SqSave

We have trained our investment system to cover the 2008 Global Financial Crisis, it is interesting how it navigates a live market crash and ongoing volatility.

Read more