This Is Your Sign to Trust Our Algorithm

2 July 2025

When timing matters, our AI doesn't hesitate.

As we closed the first half of 2025, July sees signs of calm returning to the markets. While uncertainties around the U.S. Federal Reserve’s next move remained, improving inflation data and policy stability in Europe and Asia gave investors room to breathe.

The result?

Risk appetite began to resurface, especially in equity markets — and SqSave portfolios were ready.

Our AI-optimised portfolios rebounded sharply across all risk levels, with Balanced, Growth, Aggressive, and Very Aggressive portfolios outperforming or closely matching major competitors.

The AI engine stayed disciplined, dynamically adjusting asset weights to benefit from renewed momentum while keeping a strong risk-adjusted core.

SqSave Investment Performance

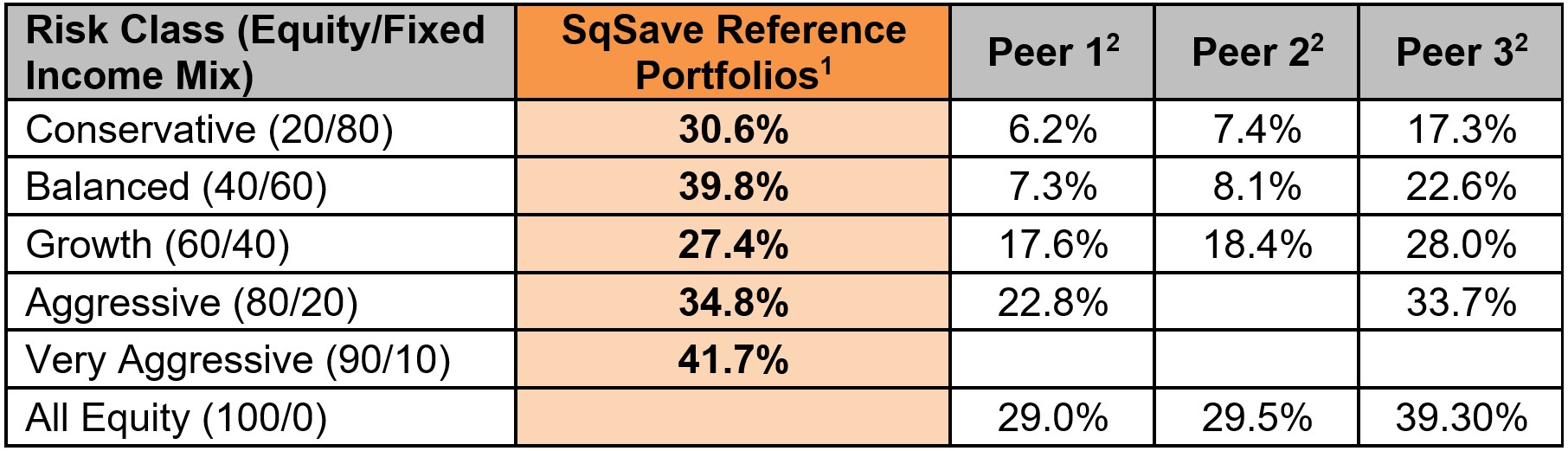

SqSave’s AI-managed reference portfolios outperformed or closely matched its most notable competitors across most risk bands on a latest 3 years cumulative total return basis to end of June 2025 (as shown below).

SqSave Reference Portfolios (3Y Cumulative Returns as of 30 June 2025):

SqSave’s edge came into sharp focus for the latest 3 years cumulative returns period to the end of June 2025:

- Balanced (39.8%) left Peer 1 & 2 trailing far behind SqSave’s returns, whilst returning almost double the returns of Peer 3.

- Growth (27.4%) beat two out of three competitors, demonstrating effective risk-balanced recovery and very closely matched Peer 3 at 28.0%.

- Very Aggressive (41.7%) topped the category, outperforming all of its above noted peers (when compared against nearest peer portfolio risk categories) — a key signal that SqSave’s AI leaned into the right opportunities at the right time to deliver stellar returns for investors.

- Aggressive (34.8%) outpaced all competitors (22.9% and 33.7%), showing strong momentum.

- Conservative boasts a 30.6% performance against much weaker returns from its peers — a remarkable reflection of SqSave’s careful risk calibration during rate-sensitive phases.

The results have proven that certainly, our algorithm’s focus on volatility versus return is tried and tested over many years of data clearly is the future of investing.

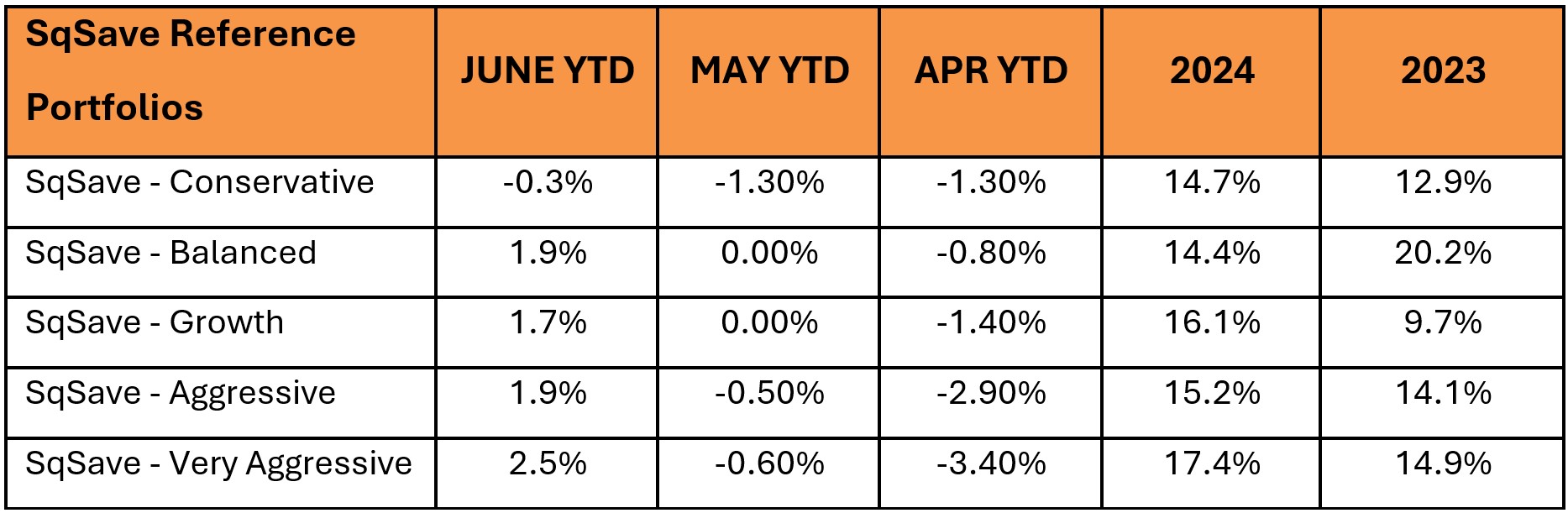

Two-Month Recovery at a Glance

June marked a powerful inflection point for all SqSave reference portfolios — capping off a second consecutive monthly turnaround that saw our AI engine steadily recover from early-year volatility to deliver positive YTD 2025 returns across every risk level except Conservative, which narrowed its drawdown significantly.

- Every portfolio improved for two straight months from April to June — a clear signal that SqSave’s AI responded early and decisively to market shifts.

- Very Aggressive posted the strongest recovery, rising 6.0% from April’s –3.4% to +2.5% YTD.

- Aggressive posted the second strongest recovery, rising almost 5% from April’s –2.9% to +1.9% YTD.

- Balanced and Growth portfolios rebounded 2.7% and 3.1% respectively from losses to end comfortably in positive territory — validating the AI’s recalibration of equity exposure amid softening inflation signals and sector rotation.

- Conservative, while still at –0.3%, maintained capital stability and reduced losses during this difficult period for fixed income.

This highlights the SqSave AI’s ability to rebalance nimbly as sentiment shifted, capturing upside while containing risk.

What It Means for Investors

SqSave’s portfolios didn’t just bounce back —they

- Increasing exposure to equity sectors regaining momentum,

- Maintaining a diversified bond position while avoiding interest rate traps, and

- Rebalancing ahead of the curve, rather than reacting after the fact.

The result was a clean performance turnaround across all risk classes — achieved with discipline, not guesswork.

An Economic Snapshot

- Global Growth: IMF maintains 2.9% global forecast, with Asia leading recovery.

- Inflation in the U.S. remained elevated: May CPI rose 2.4% YoY, slightly higher than April’s 2.3%. June readings are pending release mid July.

- ECB: Held rates steady after a June cut, citing mixed growth signals in the eurozone.

- Trade Tensions: U.S.–China relations remain strained, keeping markets alert.

- AI Optimism: Generative AI continues to drive productivity growth narratives in tech and services.

Outlook

As we enter the second half of the year, global sentiment is cautiously turning. With inflation softening and productivity gains from AI expected to pick up, markets may gradually regain momentum.

Yet risks remain — and this is where SqSave’s AI stands apart. Unlike traditional strategies, our engine responds to change immediately, without waiting for quarterly rebalances or delayed decisions.

Stability, agility, and insight — that’s the core of SqSave’s AI investing strategy.

As always, we remain committed to navigating uncertainty with discipline, precision, and purpose.

Sincerely,

SqSave Investment Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

Footnotes:

1. Portfolio returns are inclusive of ETF expense ratios and net of SqSave management fees. SqSave uses AI to design and manage diversified investment portfolios for each investor. Because SqSave is not an investment fund, there is no single return measure. Instead, every SqSave investor has his/her own investment performance as each investor is managed separately by our SqSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SqSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance.

2. Performance numbers for peers are estimates.

More Articles more

AI Driven Investing - Confidence In Uncertainty

Team SqSave

In May 2025, we saw markets caught between optimism and uncertainty, under the weight of conflicting macroeconomic currents.

Read more

INVESTMENT PERFORMANCE SWAMPED BY THE TIDE OF UNCERTAINTY

Team SqSave

On April 2, 2025, U.S. President Trump announced a sweeping set of tariffs during a Rose Garden speech, dubbing that day, "Liberation Day", a "Declaration of Economic Independence".

Read more

SQSAVE QUANTITATIVE AI ALGORITHMS DOING WELL IN THE CURRENT VOLATILITY

Team SqSave

As we alluded to in our commentary dated 10th March 2025, markets were rocked by significant market volatility – now, further stoked by the announcement of new tariffs by the U.S. administration.

Read more