As 2020 closes, what lies ahead for global investment markets?

Dec 10, 2020

Four BIG worldly things to think about…

- Geopolitics

- Economic Growth

- Monetary Policies

- Fiscal Policies

Geopolitics – Return to global cooperation, but US-China tensions will persist

Investment markets are expecting Biden to be sworn in as the next US President on 20 Jan 2020 - assuming Trump does not upset the apple cart. Investment markets do not like uncertainty.

I believe Biden’s new team will succeed in turning around the bad US Covid situation and boost the economy in the short term. However, longer term problems loom due to the huge US government debt funded by the rest of the world. How the USA manages its bloated debt will have implications on the US dollar and therefore, on its relationship with the rest of the world.

On foreign policy, I see more predictability as strained global alliances are repaired. There should be greater global coordination on economic stimulus, climate change, Covid vaccine distribution and the fight against the next pandemic.

Even then, China-US tensions will remain. Biden will not want to be seen as weak on China. Resisting the rise of China is a multi-faceted issue with bipartisan support. The USA’s China approach may tilt from trade/tech issues to human rights. However, we are likely to see a more diplomatic approach that saves face for both sides. USA-Russia tensions may also rise due to a renewed interest in the Middle East by the Biden Administration.

Overall, markets should be happier.

Economic Growth – Recovery to a new normal, but road ahead will be bumpy and long

I expect a recovery in 2021 off a low 2020 Covid base. Yet, the global economy faces headwinds. Repeated infection waves will see “start-stop” economies around the world. The Covid acceleration of digitalization has ushered in a “new normal”. Some jobs have vanished. Old jobs have morphed into new ones. Covid’s impact on supply chains will see re-engineering from global to more local. These changes will take time while the impact will be almost immediate. Government, corporate and household debts will take time to unwind. Even as vaccines become available, many sectors will remain depressed. Significant risks remain, including the possibility of ineffective vaccines due to viral mutations.

The nascent recovery is fragile and incomplete, with downside risks. The US Nov 2020 job numbers hit new highs with fears of a double-dip recession.

Monetary Policies – Interest rates likely to remain low, with negative rates possible

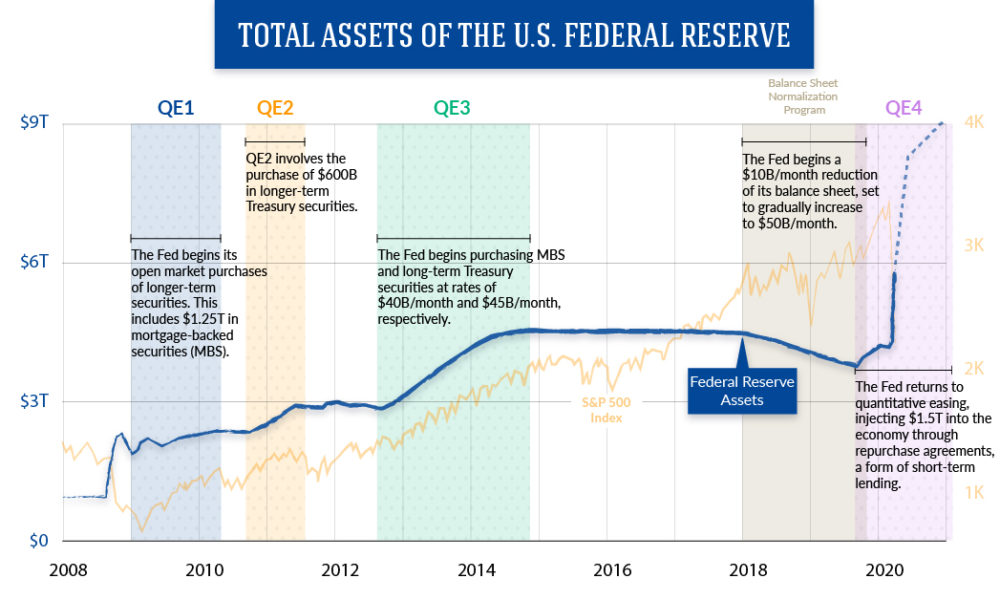

I had thought the massive printing of US dollars to prop up banks during the Global Financial Crisis and the subsequent waves of “Quantitative Easing” by the US Federal Reserve was bad. Now, all that pales in comparison to 2020. The US Federal Reserve’s 2020 balance sheet will be well over US$7 trillion. Some predict it could balloon to $10 trillion by the end of 2021!

The USA is not alone in chalking up massive debt. Many countries, including the EU bloc have added even more debt to keep their economies afloat during this ongoing pandemic. Global debt has risen significantly in 2020 compared to decades past. This means the US Fed has little room to raise interest rates. Any slight increase will mean higher debt servicing charges.

Monetary policy has become a lame duck. Interest rates are near zero. Yet, there is no sign of inflation. Well, I argue there is inflation. You just have to look at the massive jump in US stock markets in 2020. Instead of productive consumer inflation, we have non-productive financial asset inflation.

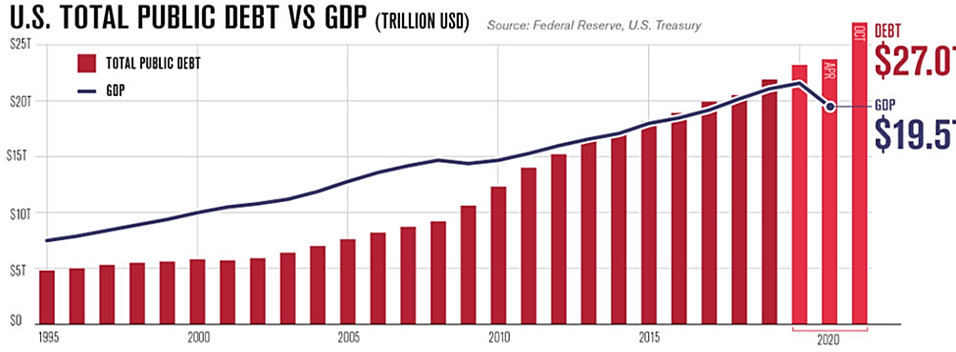

Are central banks still able to stimulate economic growth by setting interest rates? With unprecedented government debt outsizing GDP in many countries, including the USA, negative interest rates are even possible. This is uncharted territory for monetary policy.

Fiscal Policies - Global debt crisis ahead?

Covid measures included unprecedented restrictions on economic activity. To mitigate job losses, many governments subsidized wages and set up Covid relief schemes - funded by massive borrowing.

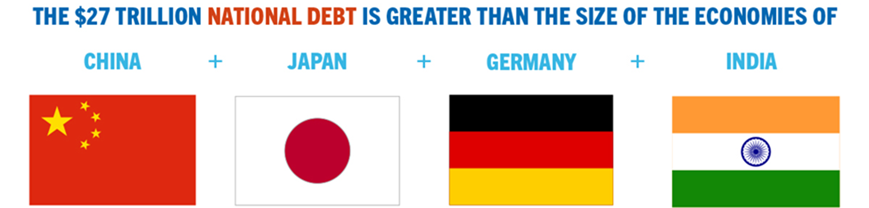

Total US government debt is now over USD 27 trillion, Bigger than the combined debt of China, India, Germany and Japan! The USA’s debt to GDP ratio is a whopping 144%!

This massive government spending mitigated the largest economic shock since the Great Depression. The IMF estimates US$11.7 trillion in discretionary fiscal spending, nearly 12 percent of global GDP. This is much more than the amount spent in the 2008-2009 Global Financial Crisis.

Despite record budget deficits, Germany and Japan are committed to more deficit spending. Within the EU, tensions may rise from arguments as to which EU member should fund the rest. Emerging economies and low-income countries face constraints with limited fiscal policy space.

The US Federal budget deficit stands at US$4.2 trillion. There is no wiggle room. To keep the economy going and to support the unemployed, Government spending has to increase. With the poor economic situation, taxation will not generate enough revenue.

Governments will probably run budget deficits due to political pressure, with debt rising even more.

How do we invest for 2021?

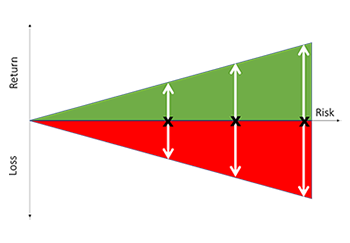

In every crisis, there is opportunity. The challenge is to find the winners. It will not be easy to win all the time. Hence, our sharing in past webinars on eating the “only free lunch in investing” – through diversification. A useful reference is how SqSave navigated the Covid crash in Feb/Mar 2020.

In our coming webinar, I will share my thoughts on how the four BIG worldly things may play out.

- Geopolitics

- Economic Growth

- Monetary policies

- Fiscal policies

I will also share how SqSave can help navigate the uncertain times ahead I will do this using the first SqSave portfolio which was invested in June 2019 and track how SqSave walked through the actual Covid market crash. And of course, I will share what our SqSave AI seems to be saying about 2021.

Regards

Victor Lye CFA CFP®

Founder & CEO, SqSave

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

Blistering November Gains for Stock Markets Even As Covid Rages On

Team SqSave

Enthusiasm about vaccines drove USA stock markets to record highs in November 2020.

Read more

Risk Management Still Critical - As It Always Has @ SqSave

Team SqSave

In the past two weeks, the stock market has become choppy. Headlines scream about the largest fall since whenever. That’s obvious, right?

Read more

The Best Time to Invest?

Team SqSave

Sorry to burst your bubble. There is no such thing as the best time to invest, unless you are a historian.

Read more