SqSave Outperforms in 2025 and Over a 3-Year Investment Cycle

2 January 2026

SqSave portfolios delivered strong results in 2025

As 2025 draws to a close, it is worth stepping back from month‑to‑month market noise and assessing performance over what truly matters to investors: a full investment cycle. Markets rarely move in straight lines, and short‑term volatility often obscures the real test of an investment strategy with consistency, resilience, and disciplined execution over time.

Against this backdrop, SqSave portfolios delivered strong results in 2025, outperforming benchmarks and most peers across risk levels, while continuing to demonstrate the core strength of our active, AI‑driven investment approach.

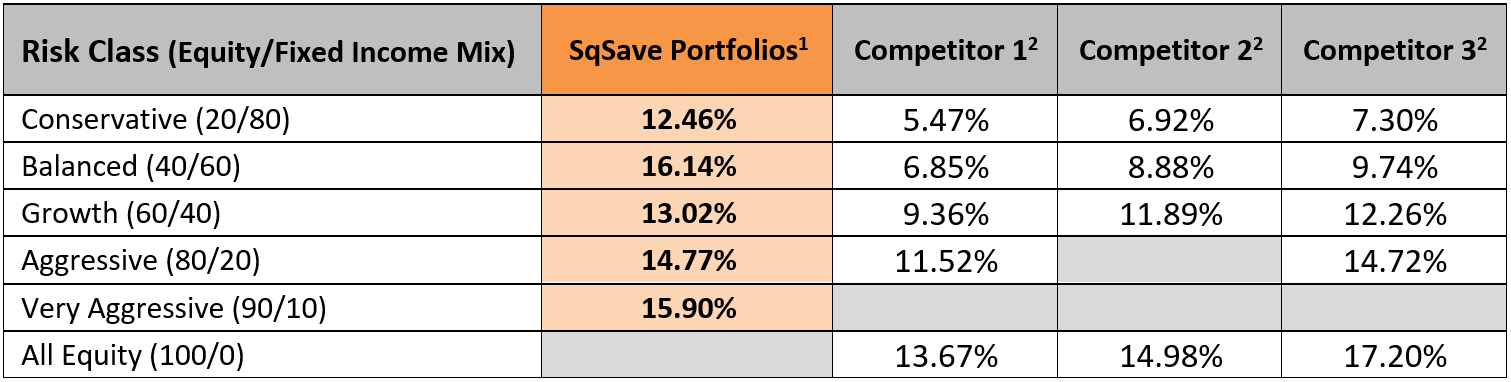

For the calendar year ended 2025, our SqSave portfolios outperformed every peer portfolio that we track. The lowest risk portfolio achieved a remarkable 12.46% annual return while our highest risk portfolio returned 15.90% for the year.

Key takeaways:

All portfolios ended 2025 solidly in the black on a full year basis, despite increased volatility in Q4.

Our Very Aggressive reference portfolio managed to deliver impressive returns despite the Q4 equity volatility in the markets, reflecting effective participation in equity upside earlier in the year.

Balanced and Growth portfolios also delivered strong full-year recoveries, helped by the benefits of diversified exposures across equities and lessor correlated asset classes like fixed income and alternative assets like gold (via GLD ETF), which our AI has maintained a strong overweight allocation to in all reference portfolios.

The Conservative reference portfolio preserved capital effectively by closing the year with double-digit gains for the 3rd year running, reinforcing SqSave’s commitment to downside protection while maximising returns on a risk adjusted basis.

This full-year performance arc once again demonstrates that SqSave’s AI adapts systematically, reducing risk when conditions soften and reallocating when opportunities improve.

Investing Across the Cycle: 3‑Year Performance Matters

At SqSave, we use data to invest - recognising that yearly investment returns reflect the inevitability of investment market cycles. Data suggests that every market correction typically reverts to the mean over a 1-to-3-year time frame. Hence, relying solely on annual returns may actually disguise the true underlying performance of our tried and tested risk-managed algorithms which is not based on a trading or short-term approach.

SqSave 3-Year Annualised Performance vs Benchmarks and Peers

For a meaningful assessment of investment outcomes, it is important to look beyond single-year results. We therefore compared SqSave portfolios against industry peers on a three-year annualised basis, aligning with our view that investing is a multi-year discipline best evaluated across a full market cycle.

This comparison highlights where SqSave’s active quantitative management adds the most value, particularly in diversified, multi-asset portfolios where static allocation approaches may fall short.

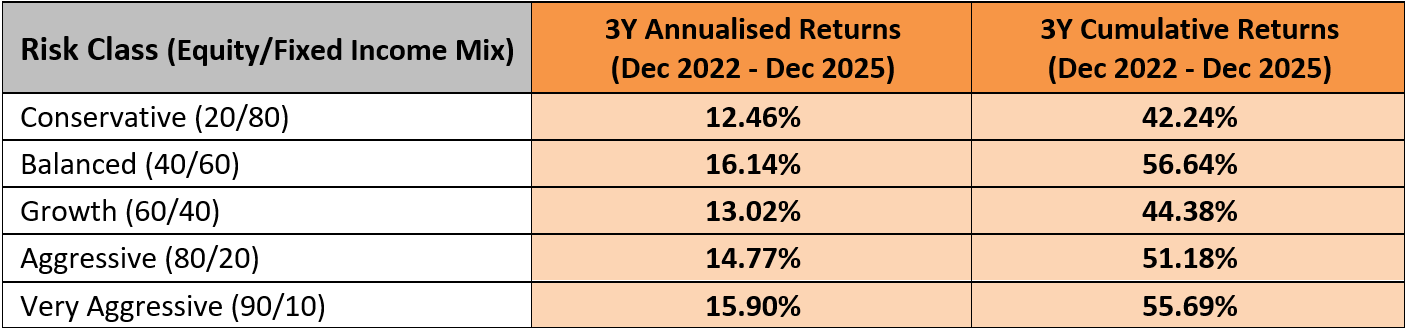

SqSave Reference Portfolios: 3 Year Annualised Returns & 3-Year Cumulative Returns for the period of December 2022 – December 2025

Key observations:

Over a full three-year investment cycle, SqSave outperformed peers across all diversified risk profiles, from Conservative through Very Aggressive.

The strongest relative outperformance continues to appear in Balanced and multi-asset portfolios, where dynamic risk management and allocation discipline matters.

In the 100% Equity category, a peer portfolio delivered higher returns, reflecting that outcomes in pure equity strategies are driven largely by market beta rather than portfolio construction.

These results reinforce an important distinction: SqSave’s edge is not in predicting short-term equity movements, but in systematically managing risk and return across diversified portfolios over time.

Investment Environment

Global Growth: Momentum continues to slow heading into 2026, with advanced economies showing softer consumption and investment trends.

Inflation: Inflation has continued to ease gradually, though core inflation remains above central bank comfort levels, keeping policy expectations cautious.

US Federal Reserve: US Policy Interest Rate was cut by another 0.25% in December (its 3rd in 2025) to the 3.5%-3.75% level. However, some dissention appeared among some hawkish policymakers, leaving an air of uncertainty hanging over where policy is headed in early months of 2026. In addition to the rate decision, the Fed also said it will resume monthly buying of USD40 billion of Treasury securities for a few months (with some experts calling it a form of stealth added easing, as a just in case measure) to shore up pressures in overnight funding markets.

Equities: Equity markets paused for a second straight month after a strong multi-month rally, with year-end profit-taking and valuation concerns weighing on sentiment.

Geopolitics & Energy: Ongoing geopolitical tensions and energy supply risks continued to inject volatility, reinforcing the need for diversification and risk management.

Outlook

As we enter the new year, markets remain finely balanced:

Inflation is trending lower, but not yet fully contained.

Monetary policy is restrictive, though increasingly stable.

Growth is slowing, but recession risks remain contained.

In 2025, markets tested investors’ patience, rewarded discipline, and punished emotion. SqSave portfolios navigated this environment with consistency, resilience, and strong results.

As we look ahead, uncertainty will remain a constant. What will not change is SqSave’s investment philosophy: data over emotion, discipline over prediction, and performance measured across cycles, not months.

Whatever 2026 brings, SqSave portfolios are positioned with discipline, agility, and resilience.

Sincerely,

SqSave Investment Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

Footnotes:

1. Portfolio returns are inclusive of ETF expense ratios and net of SqSave management fees. SqSave uses AI to design and manage diversified investment portfolios for each investor. Because SqSave is not an investment fund, there is no single return measure. Instead, every SqSave investor has his/her own investment performance as each investor is managed separately by our SqSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SqSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance.

2. Performance numbers for peers are estimates.

More Articles more

Holding Steady in Turbulent Waters

Team SqSave

As of end-October, SqSave portfolios beat every competitor in their risk class from Conservative to Very Aggressive.

Read more

Clean Sweep: SqSave Beats Every Competitor Across Every Portfolio

Team SqSave

As of end-October, SqSave portfolios beat every competitor in their risk class from Conservative to Very Aggressive.

Read more

Performance that Leads — Intelligence that Lasts

Team SqSave

As Q3 closed, global markets stayed cautiously optimistic amid sticky inflation, a steady Fed, and a tech-led earnings season that continued to support investor sentiment.

Read more