Clean Sweep: SqSave Beats Every Competitor Across Every Portfolio

4 November 2025

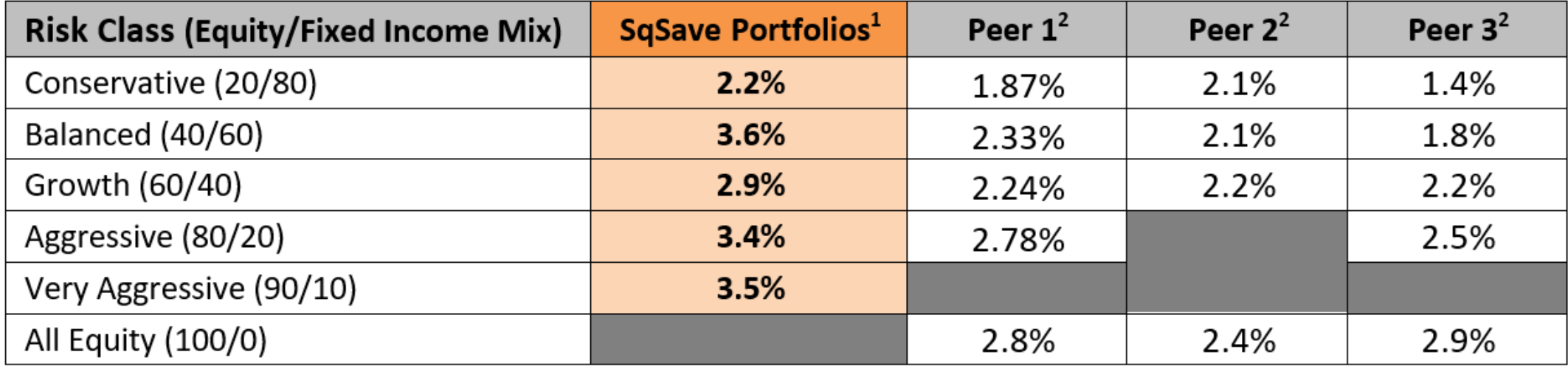

As of end-October, SqSave portfolios beat every competitor in their risk class from Conservative to Very Aggressive. In a complex environment, our AI didn’t chase. It led.

As Q4 began, global markets traded sideways, wrestling with plateauing inflation, a cautious Fed, and muted economic data. Volatility remained subdued, but direction was harder to find.

SqSave didn’t follow the drift, it stayed ahead.

With precision-led AI rebalancing, all five SqSave reference portfolios once again outperformed their competitors YTD from Conservative to Very Aggressive.

In a market lacking conviction, SqSave delivered clarity through consistency.

SqSave Investment Performance

October capped off a remarkable run of steady leadership.

Each SqSave portfolio led its respective risk category, not just by outperforming one peer, but by beating every single peer across the board.

Latest 1 Month Returns - Oct 2025

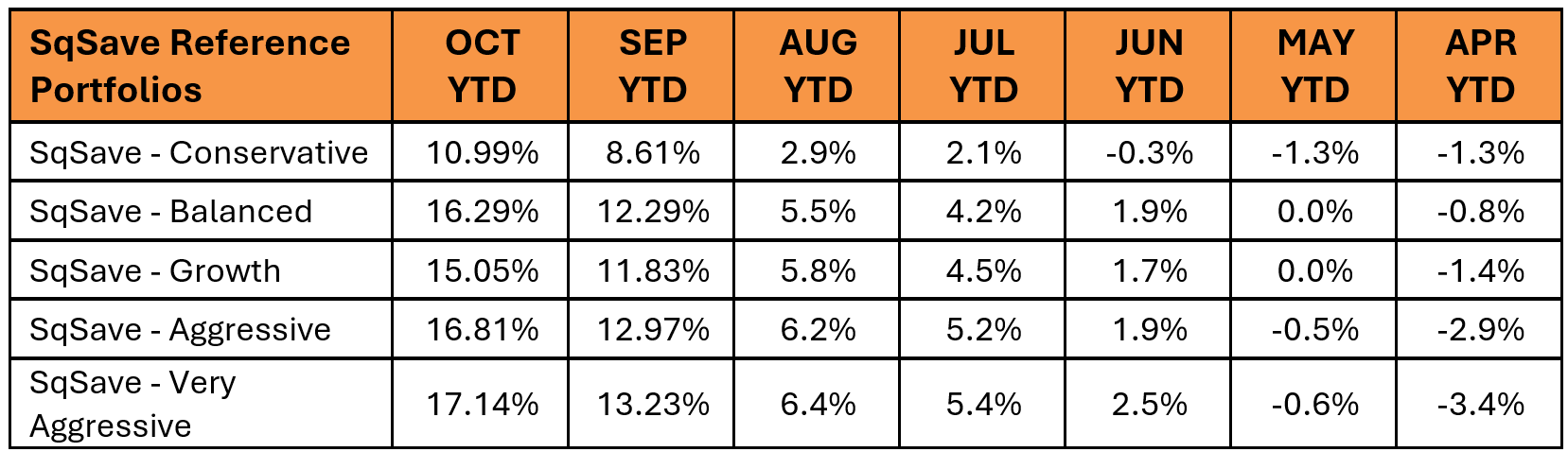

Six-Month Recovery at a Glance

From the market lows in April to the strong rally through October, SqSave’s reference portfolios have staged a compelling and disciplined comeback. Every portfolio is now firmly in positive territory through to end Q3 2025.

All portfolios are now well in the black YTD, with strong double-digit gains across the board.

Very Aggressive and Aggressive portfolios both gained roughly 20% from April lows, reflecting SqSave’s AI tilting into equity momentum early and effectively.

Balanced and Growth portfolios staged impressive turnarounds of 17.1 & 16.5%, respectively, showcasing consistency and strong diversification.

Even the Conservative portfolio — hit hardest in Q2’s fixed-income drag — rebounded nearly 12.3% since April, proving capital protection doesn’t mean missing out on recovery.

This isn’t just a rebound. SqSave’s AI read the signals early and repositioned decisively.

SqSave portfolios continued to lead by:

Maintaining equity exposure in sectors with resilient earnings and improving forward guidance,

Staying selective on fixed income, avoiding long-duration risks while preserving capital,

Relying on daily recalibration, not quarterly guesswork, to respond swiftly to real-time data.

Investment Environment

Global Growth: The IMF’s World Economic Outlook (Oct 2025) projects global GDP growth at 3.2%, slightly down from 3.3% in 2024, with advanced economies expected to slow further in Q4.

U.S. Inflation: Headline CPI for September 2025 rose to 3.0% YoY, up from 2.9% in August — a signal that inflation pressures are persisting, not easing sharply.

Federal Reserve: The US Federal Reserve lowered their benchmark interest rate by 0.25% to 3.75% to 4.00% during its late October 2025 meeting, despite signs of still sticky inflation. Keys to the Fed opting to cut rates were signs of rising growth risks, led by softening labour market conditions。

Tech & AI: U.S. earnings from major tech players in October continued to outperform, with cloud, AI infrastructure, and chipmakers leading Q3 results — further validating AI as a long-term investment theme.

Oil Prices: Brent crude hovered around $91/barrel, sustaining cost pressures across energy-intensive sectors and supporting inflationary concerns.

Outlook

As we enter the final stretch of 2025, the road ahead remains mixed.

Inflation is plateauing, not falling fast. September’s 3.0% YoY CPI shows that price pressures are holding firm, keeping central banks cautious.

Growth is slowing, especially in advanced economies. The risk of recession remains contained, at least for now.

Policy remains on a downward albeit more gradual path after the U.S. Fed recently cut its policy target rate to 3.75% to 4.0%, with uncertainty looming about a further cut in Dec 2025.

For investors, risk management remains key.

That’s why reactive strategies are at risk.

But this is not the case for SqSave’s AI. We have consistently shared our investment results for over five years now.

Whether you are an individual, corporate or institution, our disciplined SqSave investing system clearly works for risk-based investors.

And with AI at the helm, we’ll continue to invest with precision — for today, and for what’s next.

Join us in Smart Investing for Anyone, Anywhere, Anytime!

Sincerely,

SqSave Investment Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

Footnotes:

1. Portfolio returns are inclusive of ETF expense ratios and net of SqSave management fees. SqSave uses AI to design and manage diversified investment portfolios for each investor. Because SqSave is not an investment fund, there is no single return measure. Instead, every SqSave investor has his/her own investment performance as each investor is managed separately by our SqSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SqSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance.

2. Performance numbers for peers are estimates.

More Articles more

Performance that Leads — Intelligence that Lasts

Team SqSave

As Q3 closed, global markets stayed cautiously optimistic amid sticky inflation, a steady Fed, and a tech-led earnings season that continued to support investor sentiment.

Read more

Results You Can Measure. Discipline You Can Trust

Team SqSave

As we moved through August, markets maintained their cautious optimism.

Read more

Outperformance, Uploaded.

Team SqSave

As markets built on June’s momentum, July rewarded those who were already positioned — not just reacting.

Read more