Results You Can Measure. Discipline You Can Trust

4 September 2025

With three months of positive momentum, SqSave portfolios continue to deliver clarity, consistency, and confidence.

As we moved through August, markets maintained their cautious optimism. U.S. inflation plateaued for a second month, the Fed held rates steady, and economic signals remained mixed — yet generally supportive. While headline risk softened, investor sentiment continued to favour quality and consistency, particularly in the equity and balanced risk segments.

SqSave’s portfolios stayed aligned, not reactive. Powered by daily AI recalibration, our Conservative, Balanced and Growth strategies either matched or outperformed peers, while Aggressive and Very Aggressive maintained steady returns only slightly below their benchmarks and comparable portfolios.

In a market that’s rewarding precision over speculation, SqSave’s discipline showed through — consistently rebalancing, diversifying, and capturing upside without overexposure.

SqSave Investment Performance

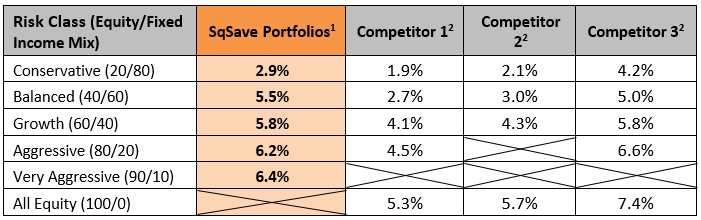

SqSave portfolios extended their winning streak into August, with three out of five portfolios outperforming or closely matching competitors YTD. Despite a minor lag in the lowest-risk band vs. one of our tracked peers, all portfolios stayed in the black while keeping above pace vs. their benchmarks — showing consistency, control, and competitive edge.

Latest YTD 2025 Returns as at 31 Aug 2025

SqSave’s portfolios didn’t just hold steady — they pressed the advantage.

• Balanced (5.46%) beat all three competitors — a clean lead backed by steady AI-driven exposure management.

• Growth (5.83%) marginally edged out the top peer performer (5.82%), maintaining its leadership in blended risk strategies.

• Very Aggressive (6.36%) remained at the front of the high-equity pack — a clear result of smart signal-following and timely rebalancing.

• Aggressive (6.2%) still delivered strong results.

• Conservative (2.9%), continued to maintain stability and consistency through a volatile rate environment.

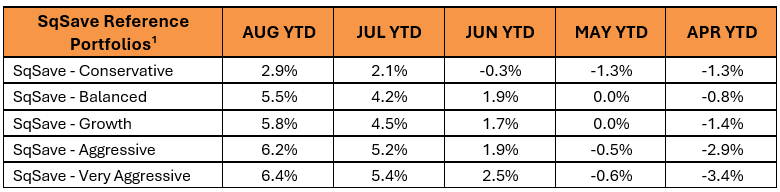

Four-Month Recovery at a Glance

From April’s lows to August’s highs, all SqSave reference portfolios delivered a strong, sustained recovery. This four-month climb reflects the AI engine’s ability to detect early inflection points, rebalance dynamically, and capture gains without overreaching on risk.

• Every reference portfolio except Conservative recovered from negative to positive YTD 2025 by end June— and built further gains in July and August.

• Very Aggressive led the charge, rebounding nearly 10% since April.

• Aggressive followed closely with a 9.1% gain, demonstrating high-conviction AI positioning in a stabilising market.

• Balanced and Growth recovered 6.3% and 7.2%, respectively — validating risk-balanced strategies in a volatile environment.

• Conservative while slower to recover, still posted a 4.2% swing — reinforcing its steady capital preservation mandate.

From deep drawdowns in Q2 to positive positioning in Q3, SqSave’s AI-driven portfolios proved their ability to adapt, pivot, and lead — all without emotional triggers or delayed rebalancing.

What It Means for Investors

The message is clear: SqSave’s AI isn’t chasing trends — it’s anticipating them.

SqSave portfolios didn’t just recover — they sustained performance through a changing macro landscape. August marked the fourth straight month of gains, driven by the AI engine’s commitment to consistency, not complacency. While sentiment shifted and markets searched for direction, SqSave’s algorithm remained clear-eyed and calculated, navigating with:

• Reinforced exposure to risk-adjusted equity sectors, benefiting from stabilising inflation and improving earnings visibility,

• Selective bond positioning that maintained capital stability while sidestepping duration-driven drag, and

• Real-time rebalancing that captured upside across Q3 — not in hindsight, but as the signals emerged.

The outcome: a full turnaround across all portfolios from April’s lows — led by data, not emotion.

In a market where conviction matters, SqSave continues to deliver steady performance with purpose.

Economic Snapshot

• Global Growth: IMF and OECD maintained their 3.0% or higher global growth outlook, with Asia and AI-driven sectors outperforming.

• U.S. Inflation: CPI for July 2025 held at 2.7% YoY, same as June — hinting that price pressures may have plateaued.

• US Federal Reserve: In the absence of any FOMC meeting, Fed’s policy interest rate held steady at 4.25–4.50% in August, although markets now expect Fed to proceed with its next cut later this month at its in September FOMC session.

• Earnings Sentiment: Continued modest strength in tech and AI-supporting sectors drove broader equity support into late Q3.

• AI Optimism: AI infrastructure, cloud, and data center investment continues to surge — supporting tech-led equity strategies.

Outlook

With US inflation showing signs of plateauing, US rate policy steady with a slight dovish tilt now being hinted at from the US Fed, and investor sentiment holding firm, SqSave’s portfolios are well-positioned for late-year shifts.

This is where SqSave’s edge is clearest:

Our AI doesn’t guess. It calculates.

It doesn’t chase. It leads.

Confidence in uncertainty — that’s the power of AI-driven investing.

Sincerely,

SqSave Investment Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

Footnotes:

1. Portfolio returns are inclusive of ETF expense ratios and net of SqSave management fees. SqSave uses AI to design and manage diversified investment portfolios for each investor. Because SqSave is not an investment fund, there is no single return measure. Instead, every SqSave investor has his/her own investment performance as each investor is managed separately by our SqSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SqSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance.

2. Performance numbers for peers are estimates.

More Articles more

Outperformance, Uploaded.

Team SqSave

As markets built on June’s momentum, July rewarded those who were already positioned — not just reacting.

Read more

This Is Your Sign to Trust Our Algorithm

Team SqSave

As we closed the first half of 2025, July sees signs of calm returning to the markets.

Read more

AI Driven Investing - Confidence In Uncertainty

Team SqSave

In May 2025, we saw markets caught between optimism and uncertainty, under the weight of conflicting macroeconomic currents.

Read more