Outperformance, Uploaded.

7 August 2025

Smart rebalancing. Solid results. That’s not luck — that’s the algorithm.

As markets built on June’s momentum, July rewarded those who were already positioned — not just reacting. U.S. inflation remained fairly stable, the Fed (U.S. Federal Reserve) stayed on hold, and U.S.’s Q2 2025 earnings season delivered upside surprises that helped sustain investor optimism.

SqSave’s portfolios didn’t just participate — they led from the front. Powered by real-time AI adjustments, all five of our risk adjusted relative return reference portfolios – namely Conservative, Balanced, Growth, Aggressive, and Very Aggressive strategies, beat or closely matched most comparable peers (except Very Aggressive), capturing opportunity without chasing it.

While others waited for the signal, SqSave was already in motion — rebalanced, diversified, and delivering strong, risk-aligned returns.

SqSave Investment Performance

SqSave portfolios posted their third consecutive month of positive returns, with AI-driven decisions allowing our portfolios to beat or match most of our closest peers’ comparable portfolios on a latest year to date (YTD) returns basis, as of July 31, 2025 (see below).

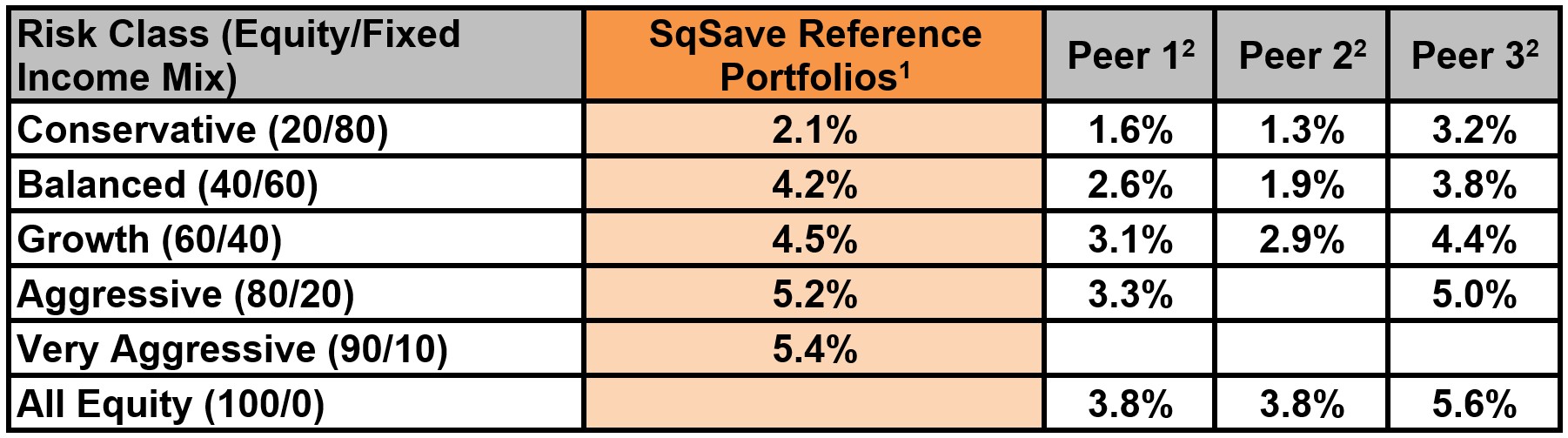

SqSave Returns vs. Closest Peers 2025 YTD (31 July 2025)

SqSave’s Edge Came into Sharp Focus Again – YTD to End July 2025

• Balanced (4.2%) outperformed all three tracked peers, showcasing consistent risk-managed returns delivery and maintaining leadership across the mid-risk spectrum — a reflection of the algorithm’s ability to adjust dynamically to market shifts.

• Growth (4.5%) closely matched the best tracked competitor (i.e. Peer 3 at 4.4%) and outpaced the others, reaffirming SqSave’s strength in optimising performance across slightly higher risk tilted equity–bond portfolios.

• Very Aggressive (5.4%) continues to top its category, delivering market-leading returns that exceeded 2 of 3 tracked competitors’ across similar high-equity portfolios — a strong indicator of SqSave’s AI positioning ahead of equity rallies.

• Aggressive (5.2%) posted strong outperformance versus all three listed competitors, slightly edging out the best (Peer 3 at 5.0%), proving the algorithm’s ability to time equity risk intelligently.

• Conservative (2.1%), while trailing one competitor (Peer 3) at 3.2%, remained solidly in positive territory ahead of the rest, reflecting careful risk calibration in lower-risk asset classes amid a shifting rate environment.

SqSave reference portfolios also surpassed all its comparable benchmark returns across the board over the same YTD period. These results reinforce the reliability of SqSave’s AI — engineered not for speculation, but for sustainable, long-term performance.

Volatility-aware. Peer-tested. Future-ready.

Three-Month Recovery at a Glance

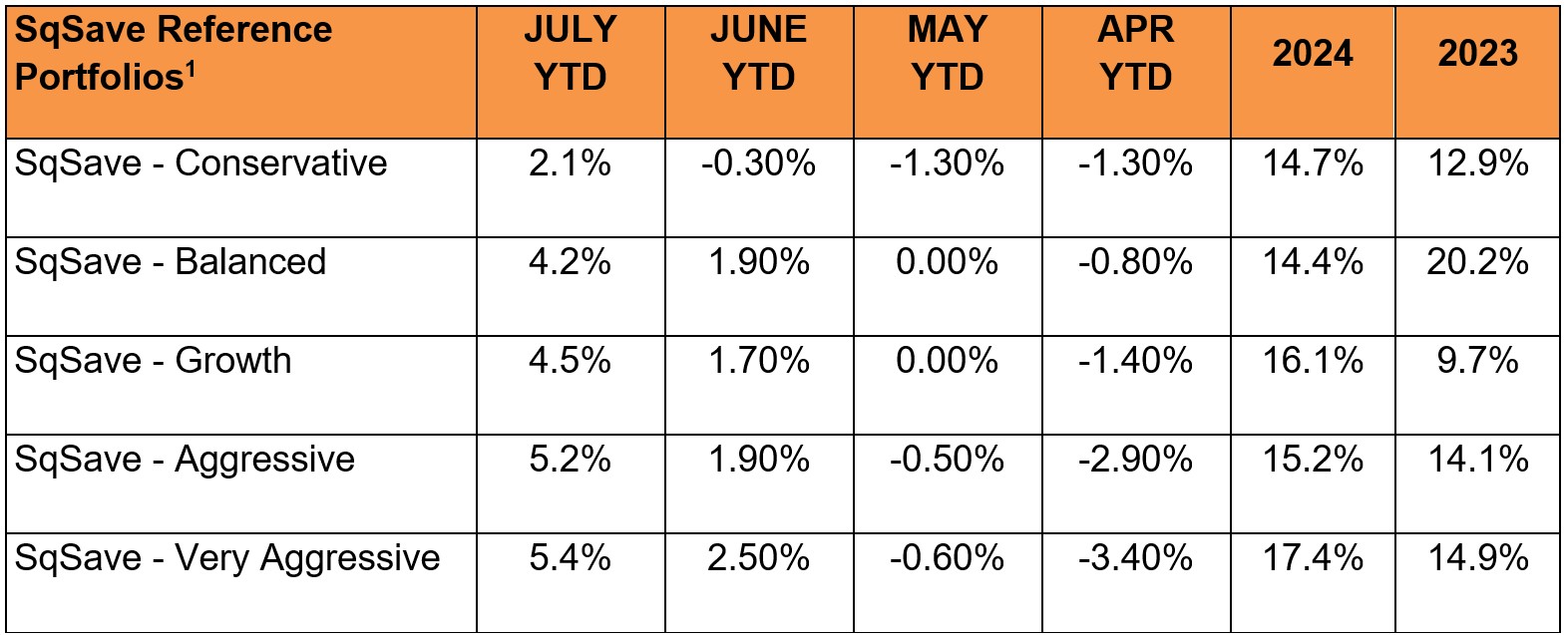

July marked the third consecutive month of strong gains for SqSave reference portfolios (as reflected in the below table) — a sustained rebound from April’s early-year volatility. The AI’s proactive recalibration has now delivered positive 2025 YTD performance (to 31 July 2025) across all portfolios, including Conservative, which moved decisively into the green.

Every portfolio has now delivered three consecutive months of improvement, turning Q2 weakness into Q3 strength — powered by timely, data-driven allocation shifts.

• Very Aggressive surged from –3.4% in April to +5.4% YTD, an astounding +8.8% recovery in just a quarter!

• Aggressive rose from –2.9% to +5.2% YTD, up a stellar 8.1% — driven by early re-engagement with equity upside.

• Balanced climbed from –0.8% to +4.2% YTD, a dazzling 5.0% recovery and Growth from –1.4% to +4.5% YTD, up by almost 6% reaffirming the algorithm’s steady positioning through volatility.

• Conservative flipped from –1.3% to +2.1%, delivering a heartening 3.4% upwards swing in a rate-sensitive environment where many peers still lagged.

This consistent, portfolio-wide recovery reflects SqSave AI’s ability to adapt early, manage volatility, and reallocate intelligently — all without emotion, delay, or distraction.

What It Means for Investors

SqSave portfolios didn’t just ride July’s momentum — our AI anticipated it. The AI engine continued to demonstrate how real-time data, not delayed reactions, drive better results. As volatility eased and investor optimism returned, SqSave’s algorithmic strategy stayed focused and dynamic by:

• Tilting toward equity sectors benefiting from earnings upside and AI-led growth,

• Maintaining bond exposure selectively, avoiding duration risks in an uncertain interest rate path, and

• Executing forward-looking rebalances — not based on headlines, but on quantitative signals.

The result: a third consecutive month of gains across all risk levels, with SqSave portfolios consistently outperforming or matching most of our closest peers. It was not luck.

It was logic — and machine-learned precision.

An Economic Snapshot

• The IMF upgraded global growth forecasts to 3.0% for 2025 (up from earlier projections), reflecting improving trade conditions and better financial stability.

• U.S. Inflation: CPI rose to 2.7% YoY in June, slightly above May's 2.4% YoY, but within expectations, supporting market stability.

• U.S. Federal Reserve: Rates (Fed Funds Interest Rates) were held steady at the Fed’s July FOMC meeting at 5.25%–5.50%, with no cuts expected before Q4 2025.

• Q2 2025 Earnings season continued to support market confidence; while an aggregate of almost 200 S&P 500 constituents’ earnings at latest check beat expectations by 6.4% (according to LSEG data), tariff pressures and select misses added layers of caution—revealing a nuanced performance landscape.

• Corporate spending on AI infrastructure is surging. In Q2, Arista hiked its full-year forecast amid strong AI hardware demand, and broader Big Tech investment is fuelling a trillion-dollar buildout of data centers and compute infrastructure.

Outlook

With three months of portfolio gains and improving global macro sentiment, SqSave enters the second half of 2025 with confidence — but not complacency. Inflation, while stabilising, remains above target. Major Central banks are cautious. And geopolitical tensions still linger.

This is where SqSave’s edge is clearest:

- No emotional bias.

- No lagging rebalances.

- Just data-driven decision-making, daily.

Our AI watches the market so investors don’t have to — ready to deliver stability, pivoting with agility, and insight across every cycle.

As always, we remain committed to navigating uncertainty with discipline, precision, and purpose.

Sincerely,

SqSave Investment Team

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

Footnotes:

1. Portfolio returns are inclusive of ETF expense ratios and net of SqSave management fees. SqSave uses AI to design and manage diversified investment portfolios for each investor. Because SqSave is not an investment fund, there is no single return measure. Instead, every SqSave investor has his/her own investment performance as each investor is managed separately by our SqSave AI. As investors can withdraw and top-up any time, investment returns will be affected by individual investor decisions. Hence, SqSave uses reference portfolios which are actual portfolios managed on an ongoing basis, without any interference with withdrawals or top-ups, to measure investment performance.

2. Performance numbers for peers are estimates.

More Articles more

This Is Your Sign to Trust Our Algorithm

Team SqSave

As we closed the first half of 2025, July sees signs of calm returning to the markets.

Read more

AI Driven Investing - Confidence In Uncertainty

Team SqSave

In May 2025, we saw markets caught between optimism and uncertainty, under the weight of conflicting macroeconomic currents.

Read more

INVESTMENT PERFORMANCE SWAMPED BY THE TIDE OF UNCERTAINTY

Team SqSave

On April 2, 2025, U.S. President Trump announced a sweeping set of tariffs during a Rose Garden speech, dubbing that day, "Liberation Day", a "Declaration of Economic Independence".

Read more